modified business tax rate nevada

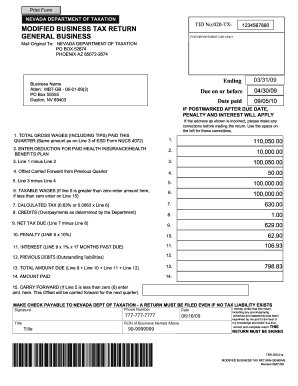

General Business u2013 The tax rate for most General Business employers as opposed to Financial Institutions is 1475 on wages after deduction of hEvalth benefits paid by the employer and certain wages paid to qualified veterans. What is Nevadas business tax.

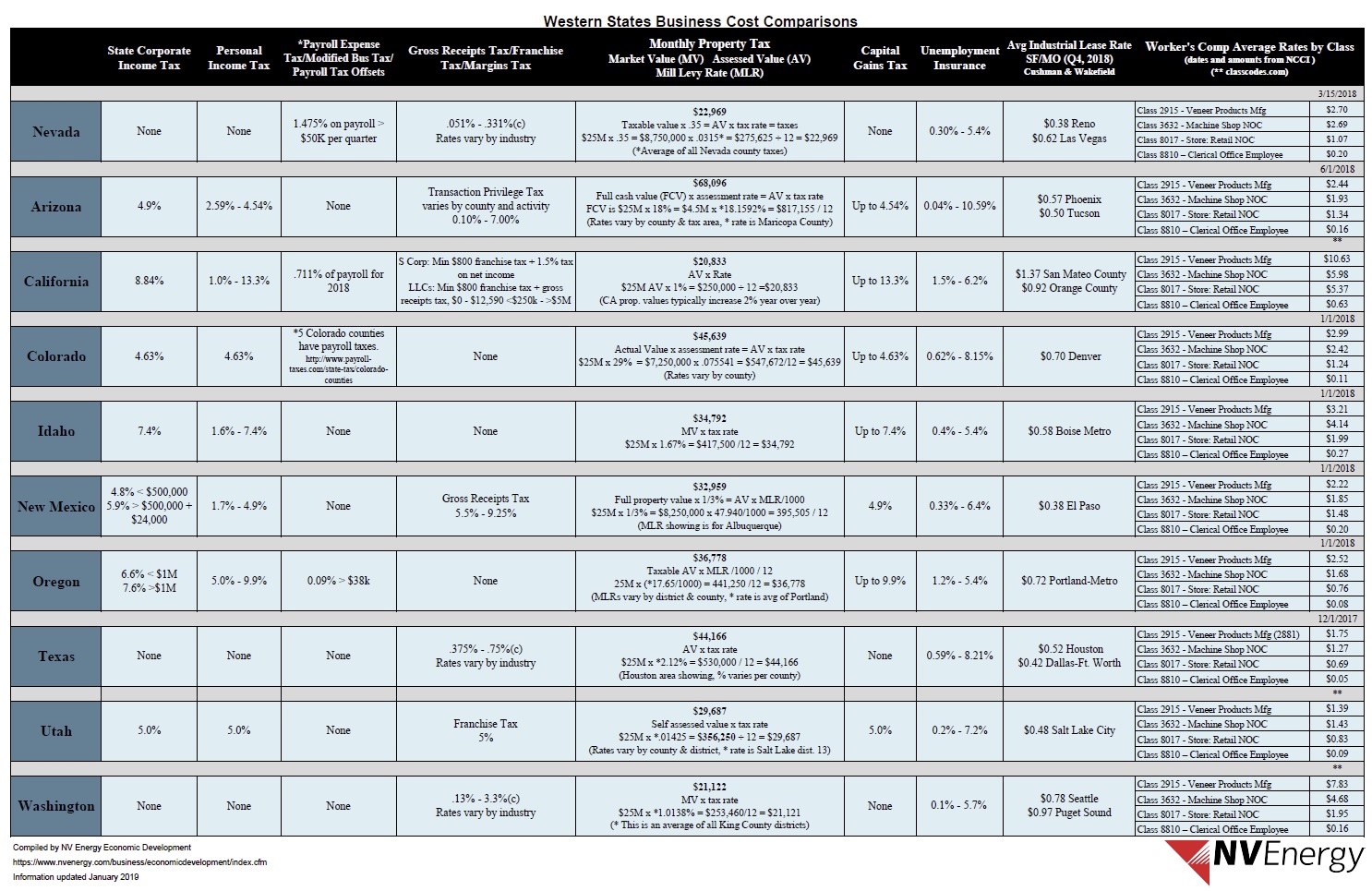

Nevada Taxes Incentives Nv Energy

Ad pdfFiller allows users to edit sign fill and share all type of documents online.

. On May 13 2021 the Nevada Supreme Court upheld a decision that Senate Bill. Tax Bracket gross taxable income Tax Rate 0. On May 13 2021 the Nevada Supreme Court upheld a decision that the biennial Modified Business Tax rate adjustment was unconstitutional and ordered the Nevada Department of Taxation to refund any overpayment of the Modified Business Tax plus interest to businesses.

But remember your business is still liable for federal taxes. Nevada Unemployment Insurance Modified Business Tax. If your business has taxable wages that exceed 62500 in a quarter then the MBT is applied.

Henderson Nevada 89074 Phone. Since the passage of the Tax Cuts and Jobs Act in December of 2017 the corporate tax rate has been changed to a flat 21. The Nevada business tax as defined for the general business category is pursuant to NV Rev Stat 363B 2017.

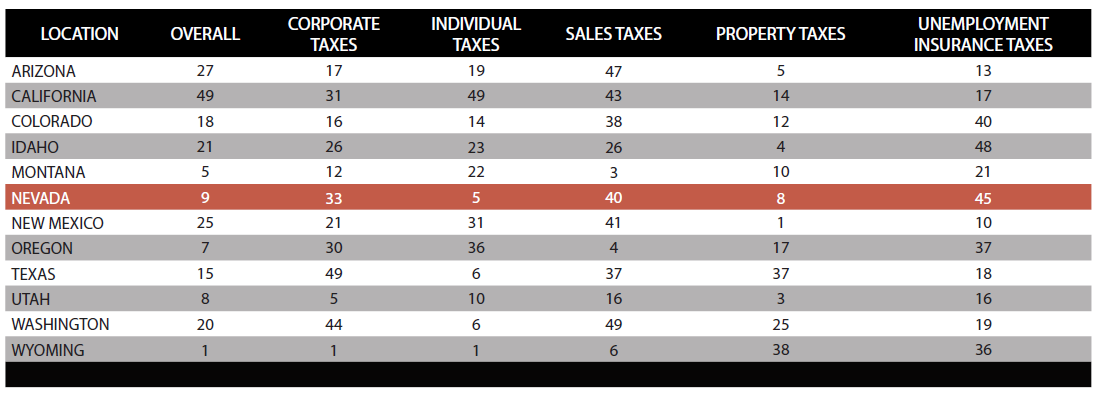

Get a personalized recommendation tailored to your state and industry. Nevada has no state income taxes. Nevada has a 685 percent sales tax rate and a max local rate of 153 percent with an average combined state and local sales tax rate of 823 percent.

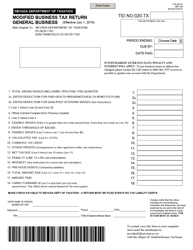

Do not enter an amount less than zero. Deductions and Credits Deductions - Veteran NRS 363A133 and Health Insurance NRS 363A135. The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1 2019.

The previous tax was set at 117 above an exemption level of 85000 per quarter although certain industries such as financial institutions paid a higher rate. If your taxable wages fall under 62500 then you do not pay the MBT. NRS 363A130 Payroll Tax.

Ad Find out what tax credits you qualify for and other tax savings opportunities. The modified business tax MBT is considered a payroll tax based on the amount of wages paid out in a quarter. Exceptions to this are employers of exempt organizations and employers with household employees only.

And if youre liable to pay unemployment insurance youre also liable to pay the modified business tax. Commerce Tax Credit Enter 50 of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed. There are no changes to the Commerce Tax credit.

Nevada has no corporate income tax at the state level making it an attractive tax haven for incorporating a business. Does Nevada have a business tax. Modified Business Tax has two classifications.

Creighton said any digital goods tax needs to be equitable because its about taxing a product digitally at the same rate whether you are buying a book in a local shop or digitally. Nevada State Payroll Taxes. Every 2019 combined rates mentioned above are the results of Nevada state rate 46 the county rate 225 to 3665 and in some case special rate 0 to 025.

The current MBT rate is 117 percent. Ad Download Or Email NV TID 020-TX More Fillable Forms Register and Subscribe Now. If youre starting a new small business congratulations you should use 295.

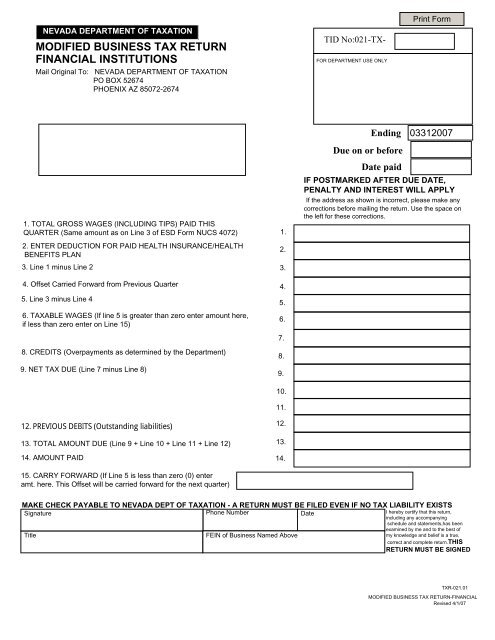

There is one general rate 1475 percent and a higher rate for financial institutions 20 percent. PdfFiller allows users to edit sign fill and share all type of documents online. Modified Business Tax Return-Financial Institutions 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for Financial Institutions as defined by NRS 360A050.

10 -Nevada Corporate Income Tax Brackets. But you knew this already. Nevada corporations still however have to pay the federal corporate income tax.

Imposition - A excise tax at the rate of 2 of the wages paid by the employer during a calendar quarter. One of the salient aspects is that the first 50000 of gross wages will not taxable. Effective July 1 2019 the tax rate changes to 1853 from 20.

The modified business tax covers total gross wages less employee health care benefits paid by the employer. What is the Modified Business Tax. Modified Business Tax Statistics Please note the following figures are based on tax-paying businesses only and are not a complete representation of total Nevada gross wages Quarterly Report March 2022.

Nevada levies a Modified Business Tax MBT on payroll wages. In 2015 legislation was enacted to reduce both MBT rates if general tax revenues exceeded a certain threshold. How do I get a modified business tax number in Nevada.

Total gross wages are the total amount of all gross wages and reported tips paid for a calendar quarter. In late 2018 the required threshold was exceeded and the MBT rates were scheduled to drop effective July 1 2019. This is after the deduction of any health benefits paid by the business or employer.

The tax rate is 1475 on wages. Multiply Line 8 x 01475 the rate established by SB483. NRS 363A130 Allowable Credit 50 of the amount of Commerce Tax paid in the proceeding taxable year.

The Department is developing a plan to reduce the Modified Business Tax rate. 702 486-3377 MODIFIED BUSINESS TAX REFUND NOTICE Dear Taxpayer During the 2019 Legislative Session Senate Bill 551 was passed which repealed the biennial Modified Business Tax rate adjustment. According to the court a bill that was passed during 2019 which prevented the previously scheduled automatic tax rate reduction form going into effect is invalid.

As we mentioned earlier there is no corporate income tax rate in Nevada.

2014 2022 Form Mt Ui 5 Fill Online Printable Fillable Blank Pdffiller

Does Qb Offer The Nv Modified Business Tax Payroll Form

Modified Business Tax Return Financial Institutions

First Round Of Nevada Modified Business Tax Refunds Issued Serving Northern Nevada

What Is The Business Tax Rate In Nevada

Nevada Taxes Incentives Nv Energy

Nevada Department Of Taxation Forms Pdf Templates Download Fill And Print For Free Templateroller

Chapter 2 The Business Tax And Financial Environments